Guide to Financial Reporting Standards in Singapore for Small Entities

A comprehensive guide to understanding and implementing SFRS for small entities in Singapore

Key Takeaways

Simplified Financial Reporting

Singapore Financial Reporting Standards for Small Entities provides a streamlined framework tailored for small entities.

Eligibility Criteria

There are specific criteria that have to be met, related to revenue, assets and number of employees.

Cost Efficacy

Businesses could save much on compliance, auditing and financial reporting costs by using this framework, allowing them to allocate their resources more efficiently.

Growth Orientation

Forging ahead with the core operations and growth strategies becomes easier with less time committed into financial reporting operations.

Compliance and Transparency

This is an approach that ensures accuracy, transparency and adherence to legal requirements in financial reporting.

Introduction

The Accounting Standards Council (ASC) designed the Singapore Financial Reporting Standards (SFRS) for Small Entities (SE), a simplified accounting framework targeted at smaller entities in Singapore. These Financial Reporting Standards became effective January 1st, 2011, to reduce the burden of financial reporting on small companies, while ensuring transparent and complete disclosures.

Eligibility Criteria

For an entity to be eligible for SFRS it has to be a small entity not publicly accountable which meets two out of three quantitative criteria:

- Total annual income should not exceed S$10 million,

- Total gross assets should not exceed S$10 million,

- Total number of employees should not exceed fifty persons.

An entity must satisfy these criteria over two consecutive years before applying the SFRS. Newly incorporated companies in Singapore can use the SFRS during their first two years if they meet these conditions that qualify them using it.

With the customised solutions offered by Growwth Partners, you can simplify your financial reporting practices and maximise your financial management efficiency. Get in touch now!

Potential Challenges and Considerations

There are certain issues that businesses must consider before taking up SFRS for Small Entities. Transition costs such as initial training or conversion of accounting systems may present a challenge. Also, if a company plans on significant growth or an IPO, there may be a need to consider full SFRS instead. Subsidiaries within a group using full SFRS might face consolidation issues.

Key Differences Between Full SFRS and SFRS for Small Entities

The full Singapore Financial Reporting Standards consists of many standards suitable for various types of firms, Singapore Financial Reporting Standards for Small Entities are meant for smaller companies. The major differences between the two include:

- Easy recognition

- Simplified measurement principles

- Fewer disclosures

- Concise reporting formats

These adjustments are intended to make it easier for small entities to prepare financial reports without compromising with quality.

Pro Tip:

Ensure you continuously monitor your company's financial metrics in order to stay eligible for SFRS, year after year. Your financial reporting should remain optimised and compliant by keeping track of any changes in SFRS or SFRS for Small Entities.

Frequently Asked Questions

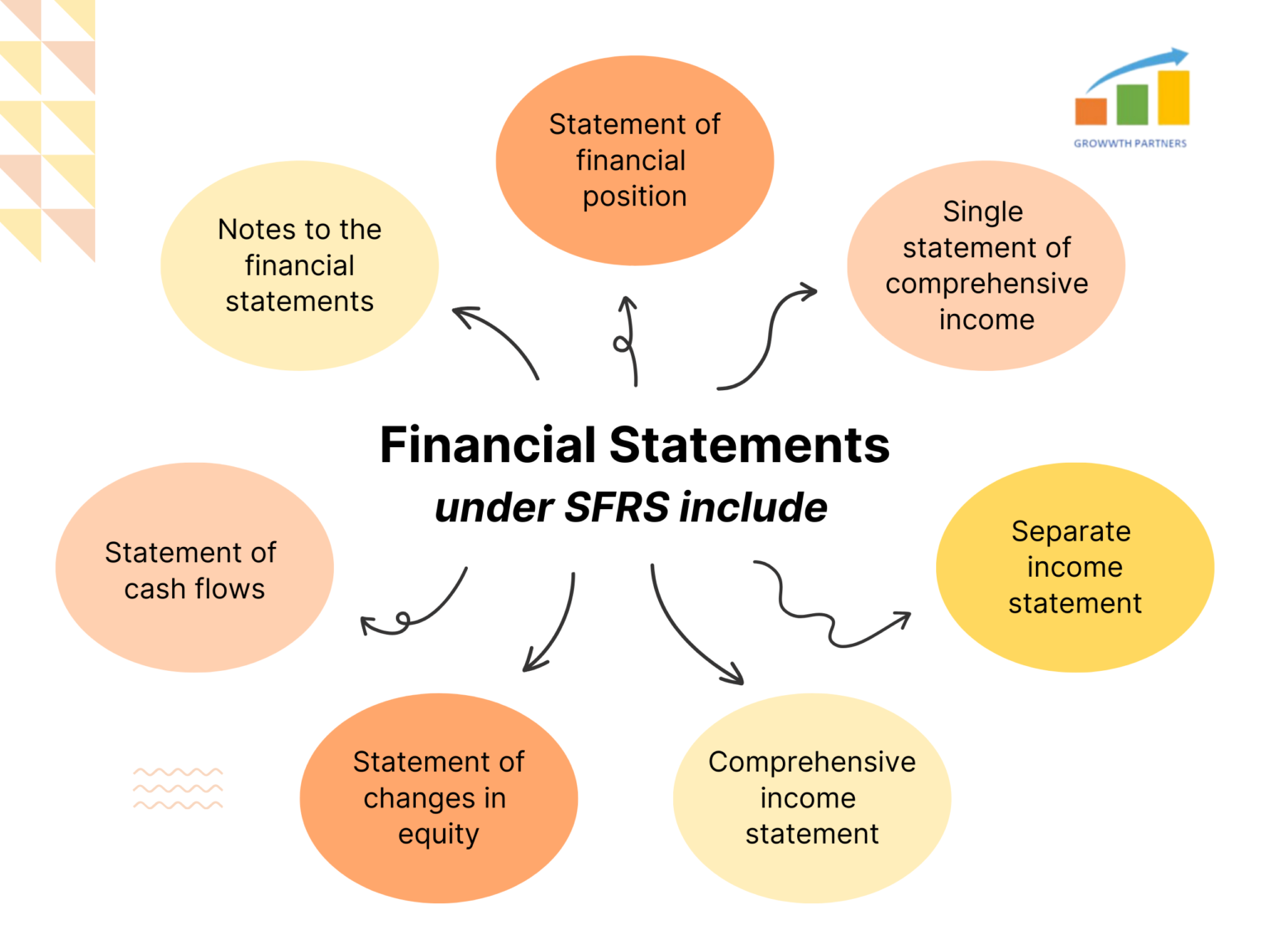

Financial Statement Presentation

Information to be Presented in the Statement of Financial Position

Also called balance sheet, this Statement of Financial Position gives a view about where things stand financially within an organisation at a particular moment. It should contain:

- Assets: Current and non-current assets such as cash, trade receivables, inventories, property, plant, and equipment.

- Liabilities: Current and non-current liabilities including trade payables, loans, and provisions.

- Equity: Owner's equity, retained earnings, and other reserves.

If presentation of additional line items or subtotals within this statement is necessary for understanding the entity's financial position then those should be provided by the concerned entity accordingly.

Information to be Presented in the Statement of Cash Flows

Statement of Cash Flows offers details regarding in & out cash movement over specific time span. It has three parts, namely:

- Operating Activities: Cash flows from principal revenue-generating activities.

- Investing Activities: Cash flows from the acquisition and disposal of long-term assets and investments.

- Financing Activities: Cash flows related to changes in the size and composition of the equity and borrowings of the entity.

For the operating activities section, entities have the option to either use the direct method (showing gross cash receipts / payments) or indirect method (where net profit is adjusted for non-cash transactions) when reporting on cash flow.

Pro-tip:

Use the indirect method when preparing the Statement of Cash Flows since it gives clearer reconciliation between net profit & cash flow from operations.

Information to be Presented in the Statement of Income and Retained Earnings

The Statement of Income and Retained Earnings presents an organisation's financial performance over a specific period. It comprises:

- Revenue: The money made from primary activities of the business.

- Expenses: All costs incurred to generate revenue, such as operating expenses, finance charges, taxes paid among others.

- Profit or Loss: The difference between earnings and expenditures.

- Retained Earnings: profits which are not distributed as dividends but kept back by the company.

A separate statement may be prepared for comprehensive income or it can be combined with an income statement showing all items recognised as revenue or expense during that particular time frame.

Information to be Presented in the Statement of Changes in Equity

The Statement of Changes in Equity presents the movement in equity components during an accounting period. It consists of:

- Total Comprehensive Income: Profit or loss for the period + other comprehensive income items.

- Transactions with Owners: Contributions from and distributions to owners (dividends, shares issuance, etc.)

- Reconciliation of Equity: Changes in equity components including retained earnings, share capital and other reserves.

For each item of equity, there is a requirement to present a reconciliation between its carrying amount at the beginning and end of the period, showing changes resulting from profit/loss, OCI (Other Comprehensive Income) and transactions with owners.

Financial Statements FAQs

Requirements for Compliance and Reporting

Consistent presentation and categorisation of financial items need to be taken extra care of by businesses that use SFRS for Small Entities. They also need to accurately record important accounting decisions and policies, as well as comparative data. Tax returns prepared under SFRS for Small Entities are acceptable to the Inland Revenue Authority of Singapore (IRAS) so long required tax adjustments are made based on prevailing rules and regulations.

Transitioning Process

The process of moving to SFRS for Small Entities entails staff training, updating accounting systems to conform to the new framework, and assessing eligibility and potential benefits.

During the transition period, small entities ought to compile a preliminary set of financial statements and evaluate their preparedness as well as any possible effects on their financial reporting.

To guarantee a seamless adoption process, create a thorough transition plan that includes deadlines, resources, and significant checkpoints.

Common Mistakes to Avoid When Transitioning

When implementing SFRS for Small Entities, a lot of businesses make common mistakes like not updating accounting systems, not meeting eligibility criteria consistently, not providing enough training for accounting staff, and not realising the importance of proper documentation and disclosures.

Do routine internal audits to find and fix any errors or gaps in compliance as soon as possible.

Transitioning FAQs

Summary

In conclusion, Singapore Financial Reporting Standards for Small Entities offer small businesses an easy-to-use, reasonably priced framework for continuing to produce transparent, legally-required financial reporting. Businesses must balance the many benefits, like lower complexity and cost effectiveness, against possible obstacles and expansion goals.

Growwth Partners is an expert in guiding companies through the challenges of financial management. Our knowledgeable staff is available to assist you, whether you're thinking about adopting SFRS or you require full-service business and financial administration.

Get in touch with Growwth Partners right now to find out more about our specialised financial management services!

Book a free call with our expert to discuss your bookkeeping needs and save time and effort.

We are here to help you!